Page 109 - Introduction to Investment Laws in Thailand

P. 109

an asset depreciated shall not be less than

137

100 divided."

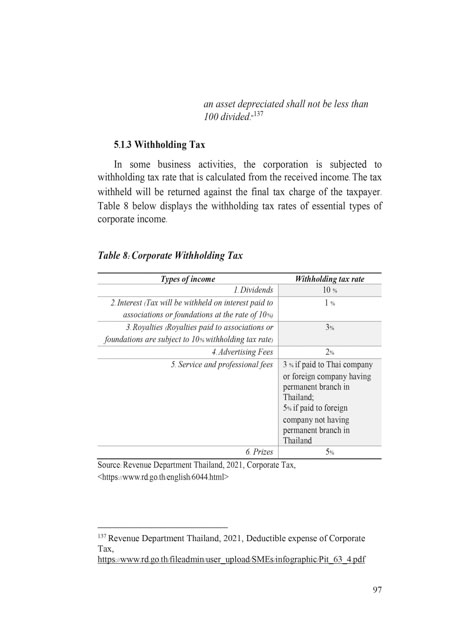

5.1.3 Withholding Tax

In some business activities, the corporation is subjected to

withholding tax rate that is calculated from the received income. The tax

withheld will be returned against the final tax charge of the taxpayer.

Table 8 below displays the withholding tax rates of essential types of

corporate income.

Table 8: Corporate Withholding Tax

Types of income Withholding tax rate

1. Dividends 10 %

2. Interest (Tax will be withheld on interest paid to 1 %

associations or foundations at the rate of 10%)

3. Royalties (Royalties paid to associations or 3%

foundations are subject to 10% withholding tax rate)

4. Advertising Fees 2%

5. Service and professional fees 3 % if paid to Thai company

or foreign company having

permanent branch in

Thailand;

5% if paid to foreign

company not having

permanent branch in

Thailand

6. Prizes 5%

Source: Revenue Department Thailand, 2021, Corporate Tax,

<https://www.rd.go.th/english/6044.html>

137 Revenue Department Thailand, 2021, Deductible expense of Corporate

Tax,

https://www.rd.go.th/fileadmin/user_upload/SMEs/infographic/Pit_63_4.pdf

97