Page 113 - Introduction to Investment Laws in Thailand

P. 113

companies or partnerships, and gains from

transferring of shares or partnership holdings;

5) income from letting of property and from breaches

of contracts, instalment sales or hire-purchase

contracts;

6) income from liberal professions;

7) income from construction and other contracts of

work;

8) income from business, commerce, agriculture,

industry, transport or any other activity not

141

specified earlier."

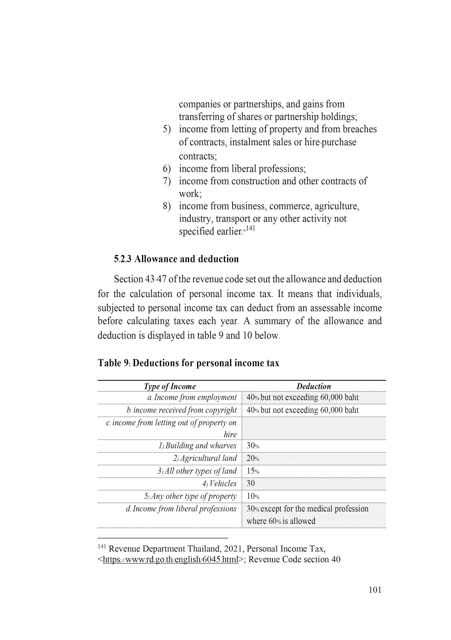

5.2.3 Allowance and deduction

Section 43-47 of the revenue code set out the allowance and deduction

for the calculation of personal income tax. It means that individuals,

subjected to personal income tax can deduct from an assessable income

before calculating taxes each year. A summary of the allowance and

deduction is displayed in table 9 and 10 below.

Table 9: Deductions for personal income tax

Type of Income Deduction

a. Income from employment 40% but not exceeding 60,000 baht

b. income received from copyright 40% but not exceeding 60,000 baht

c. income from letting out of property on

hire

1) Building and wharves 30%

2) Agricultural land 20%

3) All other types of land 15%

4) Vehicles 30

5) Any other type of property 10%

d. Income from liberal professions 30% except for the medical profession

where 60% is allowed

141 Revenue Department Thailand, 2021, Personal Income Tax,

<https://www.rd.go.th/english/6045.html>; Revenue Code section 40

101