Page 114 - Introduction to Investment Laws in Thailand

P. 114

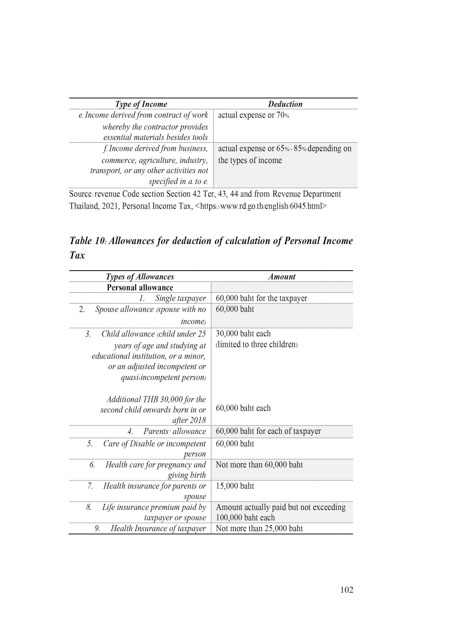

Type of Income Deduction

e. Income derived from contract of work actual expense or 70%

whereby the contractor provides

essential materials besides tools

f. Income derived from business, actual expense or 65% - 85% depending on

commerce, agriculture, industry, the types of income

transport, or any other activities not

specified in a. to e.

Source: revenue Code section Section 42 Ter, 43, 44 and from Revenue Department

Thailand, 2021, Personal Income Tax, <https://www.rd.go.th/english/6045.html>

Table 10: Allowances for deduction of calculation of Personal Income

Tax

Types of Allowances Amount

Personal allowance

1. Single taxpayer 60,000 baht for the taxpayer

2. Spouse allowance (spouse with no 60,000 baht

income)

3. Child allowance (child under 25 30,000 baht each

years of age and studying at (limited to three children)

educational institution, or a minor,

or an adjusted incompetent or

quasi-incompetent person)

Additional THB 30,000 for the

second child onwards born in or 60,000 baht each

after 2018

4. Parents’ allowance 60,000 baht for each of taxpayer

5. Care of Disable or incompetent 60,000 baht

person

6. Health care for pregnancy and Not more than 60,000 baht

giving birth

7. Health insurance for parents or 15,000 baht

spouse

8. Life insurance premium paid by Amount actually paid but not exceeding

taxpayer or spouse 100,000 baht each

9. Health Insurance of taxpayer Not more than 25,000 baht

102