Page 104 - Introduction to Investment Laws in Thailand

P. 104

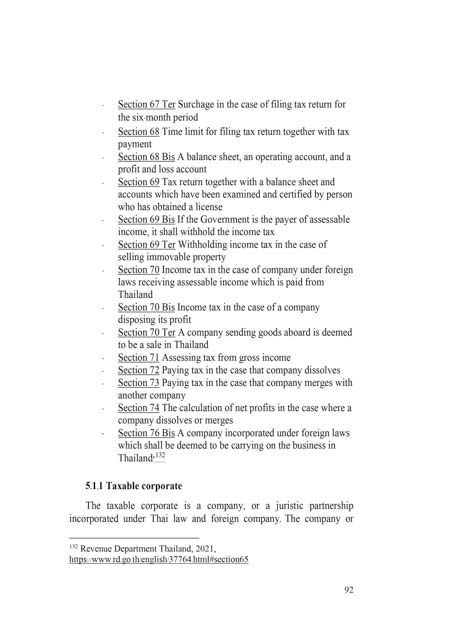

- Section 67 Ter Surchage in the case of filing tax return for

the six-month period

- Section 68 Time limit for filing tax return together with tax

payment

- Section 68 Bis A balance sheet, an operating account, and a

profit and loss account

- Section 69 Tax return together with a balance sheet and

accounts which have been examined and certified by person

who has obtained a license

- Section 69 Bis If the Government is the payer of assessable

income, it shall withhold the income tax

- Section 69 Ter Withholding income tax in the case of

selling immovable property

- Section 70 Income tax in the case of company under foreign

laws receiving assessable income which is paid from

Thailand

- Section 70 Bis Income tax in the case of a company

disposing its profit

- Section 70 Ter A company sending goods aboard is deemed

to be a sale in Thailand

- Section 71 Assessing tax from gross income

- Section 72 Paying tax in the case that company dissolves

- Section 73 Paying tax in the case that company merges with

another company

- Section 74 The calculation of net profits in the case where a

company dissolves or merges

- Section 76 Bis A company incorporated under foreign laws

which shall be deemed to be carrying on the business in

132

Thailand"

5.1.1 Taxable corporate

The taxable corporate is a company, or a juristic partnership

incorporated under Thai law and foreign company. The company or

132 Revenue Department Thailand, 2021,

https://www.rd.go.th/english/37764.html#section65

92