Page 106 - Introduction to Investment Laws in Thailand

P. 106

days of its profit remittance to its country. 135 Regarding accounting

period, juristic persons have twelve months except in the following cases

where it may be less than twelve months in cases of:

- "a newly incorporated company or juristic partnership may

elect to use the period from its incorporation date to anyone

date as the first accounting period.

- a company or juristic partnership may file a request to the

Director-General of the revenue department to change the last

day of an accounting period. In such a case, the Director-

General shall have the power to approve as he deems

136

appropriate."

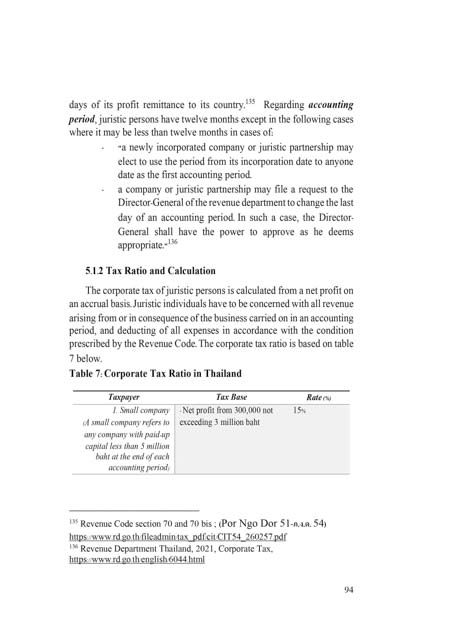

5.1.2 Tax Ratio and Calculation

The corporate tax of juristic persons is calculated from a net profit on

an accrual basis. Juristic individuals have to be concerned with all revenue

arising from or in consequence of the business carried on in an accounting

period, and deducting of all expenses in accordance with the condition

prescribed by the Revenue Code. The corporate tax ratio is based on table

7 below.

Table 7: Corporate Tax Ratio in Thailand

Taxpayer Tax Base Rate (%)

1. Small company - Net profit from 300,000 not 15%

(A small company refers to exceeding 3 million baht

any company with paid-up

capital less than 5 million

baht at the end of each

accounting period)

135 Revenue Code section 70 and 70 bis ; (Por Ngo Dor 51-ภ.ง.ด. 54)

https://www.rd.go.th/fileadmin/tax_pdf/cit/CIT54_260257.pdf

136 Revenue Department Thailand, 2021, Corporate Tax,

https://www.rd.go.th/english/6044.html

94