Page 108 - Introduction to Investment Laws in Thailand

P. 108

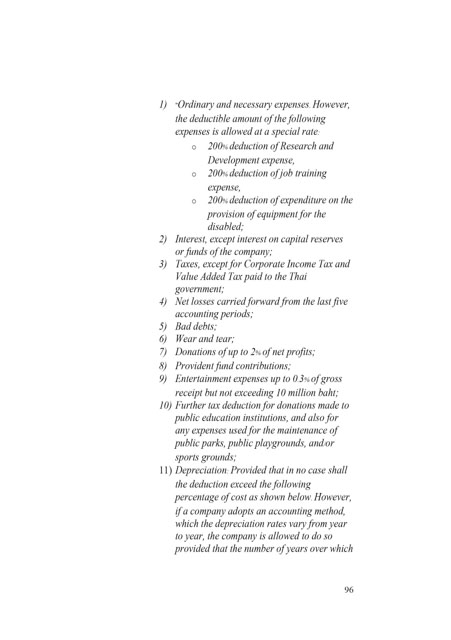

1) "Ordinary and necessary expenses. However,

the deductible amount of the following

expenses is allowed at a special rate:

o 200% deduction of Research and

Development expense,

o 200% deduction of job training

expense,

o 200% deduction of expenditure on the

provision of equipment for the

disabled;

2) Interest, except interest on capital reserves

or funds of the company;

3) Taxes, except for Corporate Income Tax and

Value Added Tax paid to the Thai

government;

4) Net losses carried forward from the last five

accounting periods;

5) Bad debts;

6) Wear and tear;

7) Donations of up to 2% of net profits;

8) Provident fund contributions;

9) Entertainment expenses up to 0.3% of gross

receipt but not exceeding 10 million baht;

10) Further tax deduction for donations made to

public education institutions, and also for

any expenses used for the maintenance of

public parks, public playgrounds, and/or

sports grounds;

11) Depreciation: Provided that in no case shall

the deduction exceed the following

percentage of cost as shown below. However,

if a company adopts an accounting method,

which the depreciation rates vary from year

to year, the company is allowed to do so

provided that the number of years over which

96