Page 107 - Introduction to Investment Laws in Thailand

P. 107

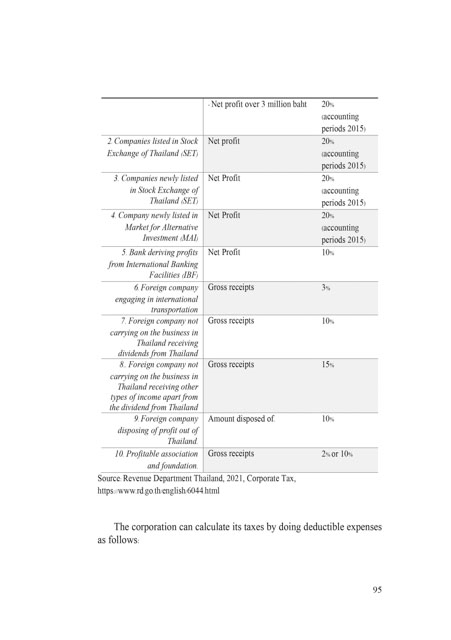

- Net profit over 3 million baht 20%

(accounting

periods 2015)

2. Companies listed in Stock Net profit 20%

Exchange of Thailand (SET) (accounting

periods 2015)

3. Companies newly listed Net Profit 20%

in Stock Exchange of (accounting

Thailand (SET) periods 2015)

4. Company newly listed in Net Profit 20%

Market for Alternative (accounting

Investment (MAI) periods 2015)

5. Bank deriving profits Net Profit 10%

from International Banking

Facilities (IBF)

6. Foreign company Gross receipts 3%

engaging in international

transportation

7. Foreign company not Gross receipts 10%

carrying on the business in

Thailand receiving

dividends from Thailand

8.. Foreign company not Gross receipts 15%

carrying on the business in

Thailand receiving other

types of income apart from

the dividend from Thailand

9. Foreign company Amount disposed of. 10%

disposing of profit out of

Thailand.

10. Profitable association Gross receipts 2% or 10%

and foundation.

Source: Revenue Department Thailand, 2021, Corporate Tax,

https://www.rd.go.th/english/6044.html

The corporation can calculate its taxes by doing deductible expenses

as follows:

95