Page 105 - Introduction to Investment Laws in Thailand

P. 105

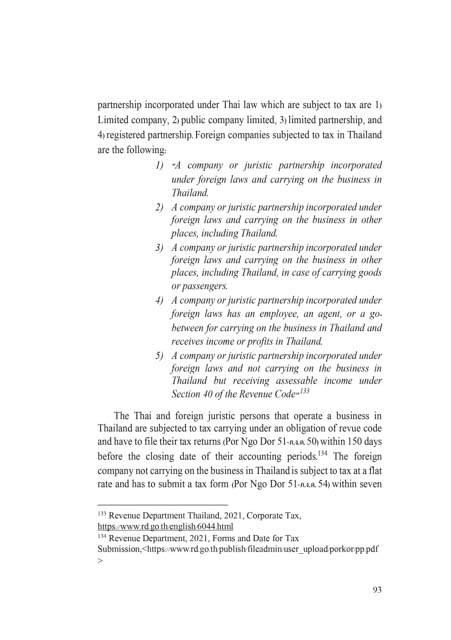

partnership incorporated under Thai law which are subject to tax are 1)

Limited company, 2) public company limited, 3) limited partnership, and

4) registered partnership. Foreign companies subjected to tax in Thailand

are the following:

1) "A company or juristic partnership incorporated

under foreign laws and carrying on the business in

Thailand.

2) A company or juristic partnership incorporated under

foreign laws and carrying on the business in other

places, including Thailand.

3) A company or juristic partnership incorporated under

foreign laws and carrying on the business in other

places, including Thailand, in case of carrying goods

or passengers.

4) A company or juristic partnership incorporated under

foreign laws has an employee, an agent, or a go-

between for carrying on the business in Thailand and

receives income or profits in Thailand.

5) A company or juristic partnership incorporated under

foreign laws and not carrying on the business in

Thailand but receiving assessable income under

133

Section 40 of the Revenue Code"

The Thai and foreign juristic persons that operate a business in

Thailand are subjected to tax carrying under an obligation of revue code

and have to file their tax returns (Por Ngo Dor 51-ภ.ง.ด. 50) within 150 days

134

before the closing date of their accounting periods. The foreign

company not carrying on the business in Thailand is subject to tax at a flat

rate and has to submit a tax form (Por Ngo Dor 51-ภ.ง.ด. 54) within seven

133 Revenue Department Thailand, 2021, Corporate Tax,

https://www.rd.go.th/english/6044.html

134 Revenue Department, 2021, Forms and Date for Tax

Submission,<https://www.rd.go.th/publish/fileadmin/user_upload/porkor/pp.pdf

>

93