Page 119 - Introduction to Investment Laws in Thailand

P. 119

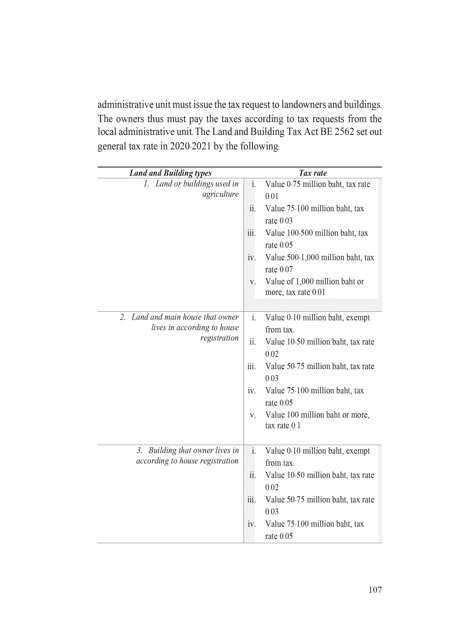

administrative unit must issue the tax request to landowners and buildings.

The owners thus must pay the taxes according to tax requests from the

local administrative unit. The Land and Building Tax Act BE 2562 set out

general tax rate in 2020-2021 by the following:

Land and Building types Tax rate

1. Land or buildings used in i. Value 0-75 million baht, tax rate

agriculture 0.01

ii. Value 75-100 million baht, tax

rate 0.03

iii. Value 100-500 million baht, tax

rate 0.05

iv. Value 500-1,000 million baht, tax

rate 0.07

v. Value of 1,000 million baht or

more, tax rate 0.01

2. Land and main house that owner i. Value 0-10 million baht, exempt

lives in according to house from tax.

registration ii. Value 10-50 million baht, tax rate

0.02

iii. Value 50-75 million baht, tax rate

0.03

iv. Value 75-100 million baht, tax

rate 0.05

v. Value 100 million baht or more,

tax rate 0.1

3. Building that owner lives in i. Value 0-10 million baht, exempt

according to house registration from tax.

ii. Value 10-50 million baht, tax rate

0.02

iii. Value 50-75 million baht, tax rate

0.03

iv. Value 75-100 million baht, tax

rate 0.05

107