Page 120 - Introduction to Investment Laws in Thailand

P. 120

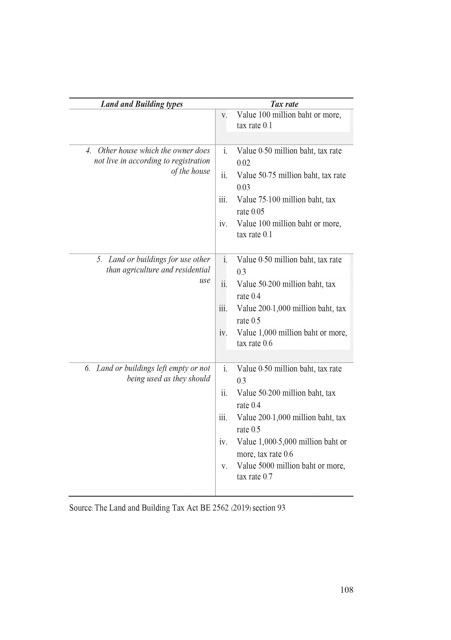

Land and Building types Tax rate

v. Value 100 million baht or more,

tax rate 0.1

4. Other house which the owner does i. Value 0-50 million baht, tax rate

not live in according to registration 0.02

of the house

ii. Value 50-75 million baht, tax rate

0.03

iii. Value 75-100 million baht, tax

rate 0.05

iv. Value 100 million baht or more,

tax rate 0.1

5. Land or buildings for use other i. Value 0-50 million baht, tax rate

than agriculture and residential 0.3

use ii. Value 50-200 million baht, tax

rate 0.4

iii. Value 200-1,000 million baht, tax

rate 0.5

iv. Value 1,000 million baht or more,

tax rate 0.6

6. Land or buildings left empty or not i. Value 0-50 million baht, tax rate

being used as they should 0.3

ii. Value 50-200 million baht, tax

rate 0.4

iii. Value 200-1,000 million baht, tax

rate 0.5

iv. Value 1,000-5,000 million baht or

more, tax rate 0.6

v. Value 5000 million baht or more,

tax rate 0.7

Source: The Land and Building Tax Act BE 2562 (2019) section 93

108