Page 115 - Introduction to Investment Laws in Thailand

P. 115

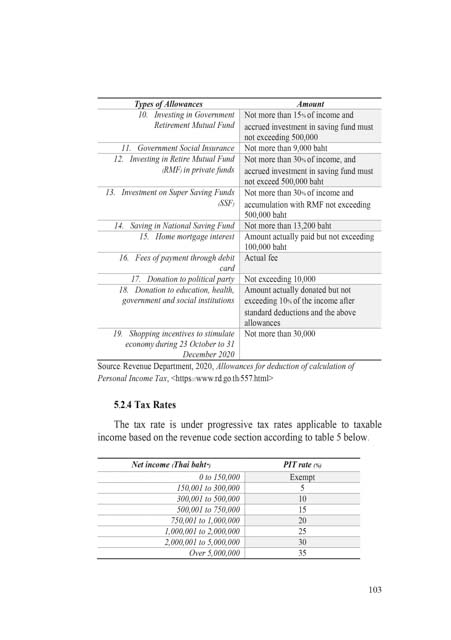

Types of Allowances Amount

10. Investing in Government Not more than 15% of income and

Retirement Mutual Fund accrued investment in saving fund must

not exceeding 500,000

11. Government Social Insurance Not more than 9,000 baht

12. Investing in Retire Mutual Fund Not more than 30% of income, and

(RMF) in private funds accrued investment in saving fund must

not exceed 500,000 baht

13. Investment on Super Saving Funds Not more than 30% of income and

(SSF) accumulation with RMF not exceeding

500,000 baht

14. Saving in National Saving Fund Not more than 13,200 baht

15. Home mortgage interest Amount actually paid but not exceeding

100,000 baht

16. Fees of payment through debit Actual fee

card

17. Donation to political party Not exceeding 10,000

18. Donation to education, health, Amount actually donated but not

government and social institutions exceeding 10% of the income after

standard deductions and the above

allowances

19. Shopping incentives to stimulate Not more than 30,000

economy during 23 October to 31

December 2020

Source: Revenue Department, 2020, Allowances for deduction of calculation of

Personal Income Tax, <https://www.rd.go.th/557.html>

5.2.4 Tax Rates

The tax rate is under progressive tax rates applicable to taxable

income based on the revenue code section according to table 5 below.

Net income (Thai baht*) PIT rate (%)

0 to 150,000 Exempt

150,001 to 300,000 5

300,001 to 500,000 10

500,001 to 750,000 15

750,001 to 1,000,000 20

1,000,001 to 2,000,000 25

2,000,001 to 5,000,000 30

Over 5,000,000 35

103