Page 8 - Introduction to Investment Laws in Thailand

P. 8

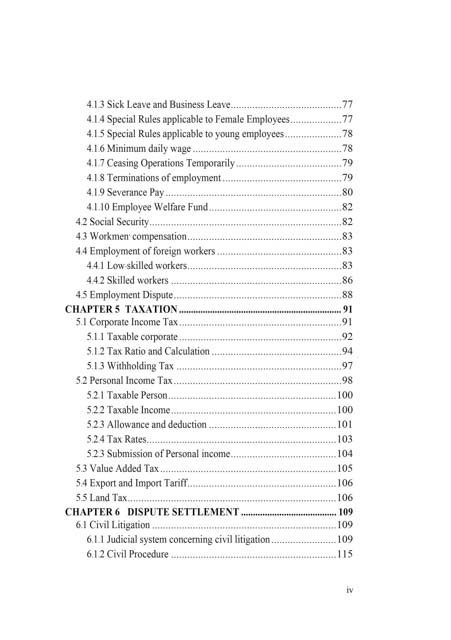

4.1.3 Sick Leave and Business Leave......................................... 77

4.1.4 Special Rules applicable to Female Employees ................... 77

4.1.5 Special Rules applicable to young employees ..................... 78

4.1.6 Minimum daily wage ....................................................... 78

4.1.7 Ceasing Operations Temporarily ....................................... 79

4.1.8 Terminations of employment ............................................ 79

4.1.9 Severance Pay ................................................................. 80

4.1.10 Employee Welfare Fund ................................................. 82

4.2 Social Security ....................................................................... 82

4.3 Workmen’ compensation ......................................................... 83

4.4 Employment of foreign workers .............................................. 83

4.4.1 Low-skilled workers ......................................................... 83

4.4.2 Skilled workers ............................................................... 86

4.5 Employment Dispute .............................................................. 88

CHAPTER 5 TAXATION .................................................................... 91

5.1 Corporate Income Tax ............................................................ 91

5.1.1 Taxable corporate ............................................................ 92

5.1.2 Tax Ratio and Calculation ................................................ 94

5.1.3 Withholding Tax ............................................................. 97

5.2 Personal Income Tax .............................................................. 98

5.2.1 Taxable Person .............................................................. 100

5.2.2 Taxable Income ............................................................. 100

5.2.3 Allowance and deduction ............................................... 101

5.2.4 Tax Rates ...................................................................... 103

5.2.3 Submission of Personal income ....................................... 104

5.3 Value Added Tax ................................................................. 105

5.4 Export and Import Tariff ....................................................... 106

5.5 Land Tax ............................................................................. 106

CHAPTER 6 DISPUTE SETTLEMENT ........................................ 109

6.1 Civil Litigation .................................................................... 109

6.1.1 Judicial system concerning civil litigation ........................ 109

6.1.2 Civil Procedure ............................................................. 115

iv